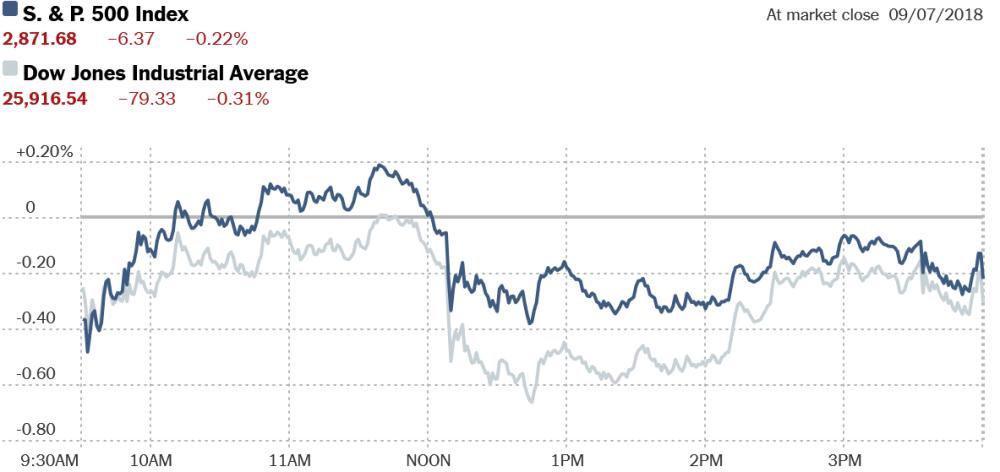

NEW YORK- Wall Street's major indexes moved lower on Friday after U.S. President Donald Trump said he had tariffs ready to impose on an additional $267 billion worth of Chinese imports, though stocks pared losses late in the afternoon.

Trump's remarks came after the comment period regarding another round of tariffs, on $200 billion worth of Chinese imports, ended on Thursday night.

Earlier, White House economic adviser Larry Kudlow said Trump would not make any decisions on those tariffs until officials evaluated public comments.

The S&P 500 and the Dow had opened lower as the U.S. Labor Department's employment report showed accelerating job growth and a surge in wage growth.

Though the report indicated a strong economy, it raised concerns among investors regarding inflation and the Federal Reserve's plans for increasing interest rates.

After Trump's comments on tariffs, both indexes added to losses, while the Nasdaq, which had been boosted by a recovery in tech stocks, gave up its gains. The three indexes recovered some of their losses later in the session.

Several investors said the unsettled stance on trade contributed to U.S. stocks' meandering path on Friday.

The Dow Jones Industrial Average fell 55.27 points, or 0.21 percent, to 25,940.6, the S&P 500 lost 2.25 points, or 0.08 percent, to 2,875.8 and the Nasdaq Composite dropped 3.01 points, or 0.04 percent, to 7,919.72.

Eight of the 11 major S&P sectors were lower. Consumer discretionary, health care and financial stocks posted modest gains.

The S&P 500 technology index was trading flat after being shellacked in the last two sessions over concerns regarding the possibility of increased regulation of social media companies.

Shares of chipmaker Broadcom Inc rose 7.5 percent after a strong current-quarter revenue forecast. The S&P 500 posted 36 new 52-week highs and 16 new lows; the Nasdaq Composite recorded 95 new highs and 62 new lows.